Price changes of raw materials for lithium iron phosphate batteries in January and February 2022

After the Spring Festival,the imbalance between supply and demand in the new energy industry chain is still there,and there is still a large amount of lithium salt destocking,resulting in a sharp rise in the price of lithium salt after the festival. According to SMM data,the average prices of battery-grade lithium carbonate and industrial-grade lithium carbonate reached 410,000 yuan/ton and 400,000 yuan/ton in February,up 26.5% and 29.5% month-on-month respectively. The sharp rise in lithium prices has led to an increase in the price of cathode materials. Among them,the average price of 5-series ternary materials in February reached 310,000 yuan / ton,up 17.6% from the previous month,and the average price of power-type lithium iron phosphate materials reached 140,000 yuan in February. / ton,up 20% month-on-month. In addition,the prices of nickel sulfate and cobalt sulfate continued to rise after the Spring Festival,up 8.5% and 6.5% month-on-month respectively.

Price changes of raw materials for 523 square ternary cells in January and February 2022

In February, the price increase of cathode materials was relatively high. In addition to the increase in the prices of raw material lithium salts and cobalt-nickel salts, it was also related to changes in the pricing mechanism of cathode materials. Beginning in the fourth quarter of last year, the pricing mechanism of lithium iron phosphate companies and battery companies began to change, from calculating the monthly average price of lithium carbonate on a third-party website to calculating the price of lithium salt in the market on the day or the price of lithium salt purchased recently. The main reason is that the lithium price has risen too fast, the proportion of long-term orders signed by lithium iron phosphate enterprises and lithium salt enterprises is relatively small, the amount of zero orders is too high, and the ability of iron and lithium enterprises to bear the increase in lithium prices has been greatly weakened. In addition, the demand for iron and lithium by battery companies has increased significantly, and the iron and lithium market is in short supply. As a result, the bargaining power of iron and lithium companies has been enhanced, the pricing mechanism has been improved, and the increase in lithium prices has been directly transmitted to battery companies.

Starting from this year, ternary material companies are also more difficult to bear the increase in lithium prices, and now they have also changed the lithium pricing mechanism to the same day lithium price or purchase price. After the pricing mechanism of ternary and iron-lithium enterprises changed, the rate of increase in lithium prices accelerated, and the cost pressure of battery enterprises continued to increase.

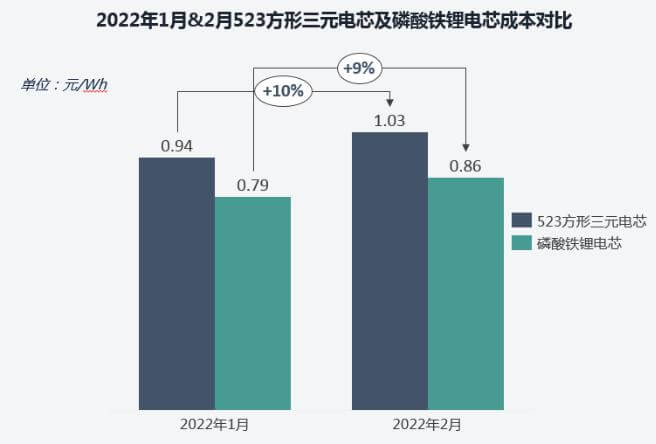

From the SMM data, the cost of ternary and lithium iron phosphate batteries has risen with raw materials since February. The cost of ternary batteries has exceeded 1 yuan/Wh in February, up 10% month-on-month; the cost of lithium iron phosphate batteries has also increased in February. It reached 0.86 yuan/Wh, up 9% month-on-month.

Since the beginning of this year, the way of signing contracts between battery companies and car companies has changed. At present, the pricing methods are mainly divided into two types. One is to adopt the monthly price linkage method, which is determined by the calculation formula of the monthly price change of raw materials on the third-party website; Signed by new car forces and small and medium-sized car companies. On the whole, the increase in raw material prices is basically borne by battery companies and car companies.

From the perspective of battery companies, the recent increase in lithium prices has had a greater impact on the cost of battery companies. Due to the difficulty of transmitting to the terminal for some small factories, the recent purchase volume has dropped significantly. Head battery companies still maintain a high purchase volume, but their acceptance of lithium carbonate prices is gradually decreasing. Judging from market news, it is difficult for most battery companies to accept lithium carbonate with a price of 480,000 yuan per ton and above, which has also forced the recent slowdown in the price increase of lithium carbonate.

From the point of view of car companies, the ORA brand recently issued an announcement, mentioning that due to the increase in raw material prices, the loss of a single black cat has exceeded 10,000 yuan. At present, the black cat and the white cat have stopped accepting orders. Under the situation of sharp rise in raw material prices, most car companies and battery companies have basically no profits or losses. Under the rapid growth of global demand for power and energy storage, it is still difficult to solve the problem of raw material supply, and the price of raw materials will continue to rise this year. It is expected that under this price increase, the downstream market demand will be affected, and other car companies may also stop production or reduce their products one after another, which may cause the production and sales of new energy vehicles this year to be lower than expected.